The IRA-LLC, (and 401(k) LLC) also called the Checkbook IRA accounts represent about 4% to 6% of the Self Directed IRAs, and sometimes these accounts can be a good idea. However, Checkbook IRAs and Solo 401(k)s come with a list of risks that their providers sometimes forget to mention.

Accidental Comingling

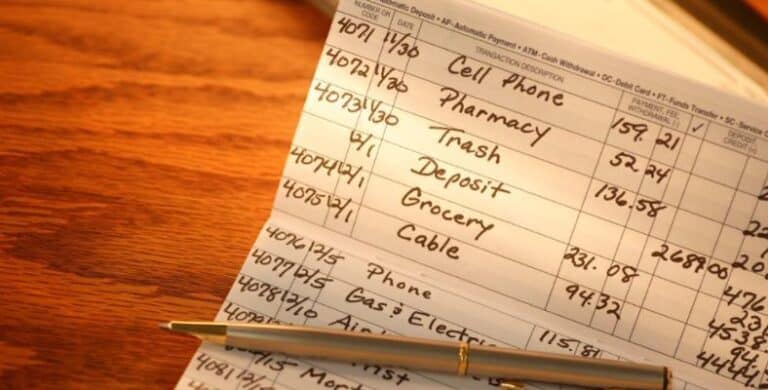

Using personal funds will cause your plan to lose its Income Tax preferred status. In addition, when caught by the IRS, this could also cost you back income tax, interest, and penalties. What may look like an innocent act could trigger an avalanche of taxes.

Example: Your Checkbook IRA or Solo 401(k) buys a house and an insurance premium becomes due. Accidentally, you pay the insurance bill with a personal check. Bing! You just created a reason for the IRS to invade your retirement savings and walk away with a lot of the money that you were saving for the future.

Personal Expenses

You may accidentally use your IRA or Solo 401(k) checkbook to pay a personal expense. That quick weekend in Las Vegas, the dinner with your out-of-town relatives at a nice restaurant could have the IRS at your door. Even purchasing a bag of chips at Home Depot is a no-no. IRA Club has a dedicated Expense department that reviews and processes your Custodial IRA expenses.

Lack of Account Success

This can be hard to believe, however, we have watched it happen repeatedly. The percent of Custodial IRA and Solo 401(k)s that are successful long term, far exceeds the percent of Checkbook IRAs and Solo 401(k)s that are successful.

Why? It is hard to put a finger on the exact reason. However, I believe it’s because no one is looking over your shoulder when you have a Checkbook Type account. Account owners get sloppy at making investments, paying bills, tracking proceeds, and filing forms.

Does the IRA Club offer both Custodial and Checkbook type accounts? Yes! However, we suggest in most cases the Custodial type of account may be the wiser choice. Custodial accounts have a lower chance of IRS violations and a better track record of long-term success. Custodial IRAs are also simpler and often less expensive than Checkbook IRAs.

For information about the Self Directed IRA or Solo 401k, call IRA Club at 312-795-0988

IRA Club offers no investments, products, or planning services. Therefore, please consult your attorney, tax professional, financial planner, and any other qualified person before making any investments. Be advised that IRA Club does not evaluate, review, monitor, recommend, warrant, guarantee, or otherwise endorse the legality, tax treatment, propriety, performance, or reliability of any investment, service, statement, opinion, or other representation provided with respect to the investment opportunities listed on its site or their sponsors or providers. IRA Club has no financial arrangement, partnership, joint venture, or other affiliation with the sponsors or providers of these investments. IRA Club shall not be liable for any misinformation, misrepresentation, negligence, act, omission, investment results, or any wrongdoing with respect to any of these investments or their sponsors or providers.