DISCOVER ALTERNATIVE OPTIONS

Investor’s Row

Did you know that you can invest your retirement account in various holding types such as rental real estate, private placements, precious metals and more?

Investor’s Row is an educational platform that offers a variety of asset classes. Once your account is open and funded, you can start selecting investments. Remember to perform your due diligence and invest in what you know and understand best. Then, make the most of your retirement funds by reaching out to one of the experts to learn more about each offering. To get started, simply click on the company you’re interested in to schedule a one-on-one consultation.

Need Inspiration On Your Next Investment?

Real Estate

Crypotocurrencies

Private Equity

Slide

Rental Real Estate

Slide

Private Placement

Slide

Precious Metals

Slide

Pre-IPO

Slide

Private Lending

What constitutes an accredited investor?

$250k individual income, $300k joint, or $1MM in total assets

Check out upcoming webinars & events

Notes

Real Estate

7e Investments

Manufactured Housing

Syndication

Turnkey Real Estate

Alpine Capital Solutions

Agricultural Land

Clean Energy

Digital Assets

Private Placement

Alternative Wealth Partners

Private Placement

Real Estate

Boxabl Inc.

Private Fund

Private Placement

Charles Dombek & Co, LLC

Private Fund

Technology

Energy Exploration Technologies, Inc.

Life Settlements

Private Equity

Equity Life

Private Placement

Technology

Flip Investor Inc

Precious Metals

GoldCore

Private Fund

Real Estate

Kirkland Capital Group

Private Fund

MF Capital Partners LLC

Private Fund

Private Placement

Real Estate

MJ Real Estate Investment Trust

Private Equity

Private Fund

Private Placement

Technology

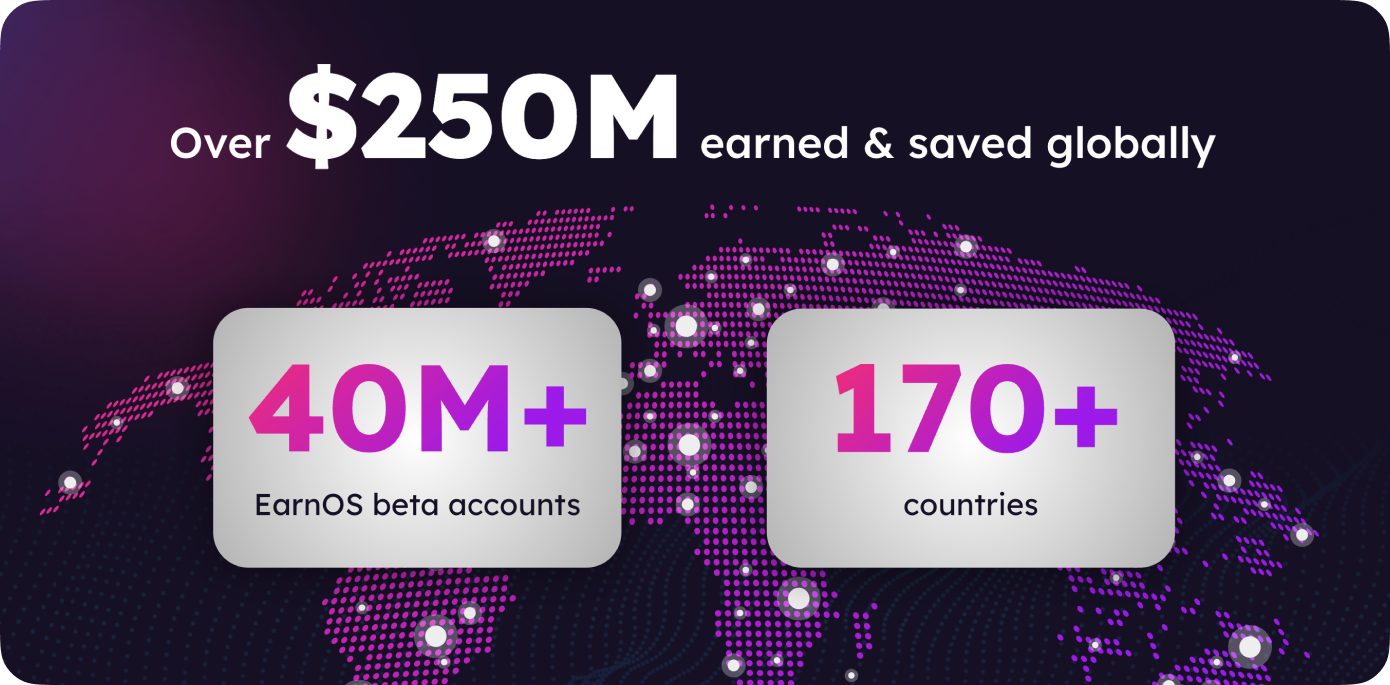

Mode Mobile

Private Equity

Real Estate

Pelorus Capital Group

Bond

Oil & Gas

Private Placement

Phoenix Capital Group

Multi-Strategy

Proxy Financial Corp

Private Placement

Real Estate

Turnkey Real Estate

Rent to Retirement

Private Equity

Private Fund

Real Estate

Spartan Investment Group

Private Placement

Real Estate

Stallion Capital Management

Lending

Notes

Real Estate

Texas Notes

Lending

Private Fund

Promissory Notes